In the dynamic world of Forex trading, mastering the art of risk management is not just a skill but a necessity for success. The global Forex market operates around the clock, offering vast opportunities for traders to profit from currency fluctuations. However, these opportunities come hand in hand with risks. To excel in the Forex market, you must learn to manage these risks effectively. In this comprehensive guide, we will explore the intricacies of risk management in Forex trading, equipping you with the knowledge and strategies needed to outperform your competitors and safeguard your investments.

Understanding the Forex Market

Before delving into risk management strategies, it’s crucial to have a clear understanding of the Forex market. Forex, short for foreign exchange, is the largest and most liquid financial market in the world. It involves the trading of currencies, where traders aim to profit from the fluctuations in exchange rates. Unlike stock markets, Forex operates 24 hours a day, five days a week, offering unparalleled flexibility.

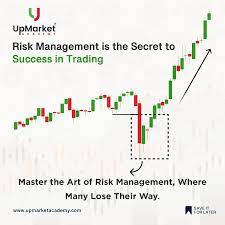

The Significance of Risk Management

In the realm of Forex trading, risk management is paramount. Without effective risk management, you’re exposed to the potential of substantial financial losses. Every trade in Forex carries a certain level of risk, which can vary based on market conditions, currency pairs, and your trading strategy. To outrank competitors and thrive in this competitive landscape, you need to implement a robust risk management strategy.

Setting Clear Objectives

One of the core principles of risk management in Forex trading is setting clear objectives. What do you aim to achieve with your trading activities? Are you looking for short-term gains or long-term stability? Defining your goals helps you tailor your risk management strategy accordingly.

Position Sizing

Determining the appropriate position size for each trade is vital. This involves calculating the amount of capital you’re willing to risk on a single trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on a single trade. This approach ensures that a single loss does not wipe out your entire account.

Utilizing Stop-Loss Orders

Stop-loss orders are a Forex trader’s best friend. These orders automatically close your position when the market moves against you, limiting potential losses. By placing stop-loss orders strategically, you can mitigate risks and secure your investments.

Diversification

Diversifying your portfolio is another key aspect of risk management. By trading different currency pairs and assets, you spread the risk, reducing the impact of a poor-performing trade on your overall account balance.

Risk-Reward Ratio

The risk-reward ratio is a fundamental concept in risk management. It represents the relationship between the potential profit and potential loss on a trade. A favorable risk-reward ratio ensures that the potential reward is significantly greater than the risk. For example, aiming for a 2:1 risk-reward ratio means that for every dollar you risk, you have the potential to gain two dollars.

Continuous Learning and Adaptation

To outperform competitors in Forex trading, you must embrace continuous learning and adaptation. The Forex market is ever-evolving, with new trends and factors influencing currency values. Staying updated with economic indicators, geopolitical events, and market sentiment is crucial for informed decision-making.

The Psychology of Trading

In addition to technical and fundamental aspects, the psychology of trading plays a significant role in risk management. Emotional control, discipline, and patience are attributes that set successful Forex traders apart. Impulsive decisions and emotional reactions can lead to poor risk management and substantial losses.