In the ever-evolving world of Forex trading, one of the often-overlooked factors that can significantly impact your success is the role of emotions. While many trading strategies focus on technical analysis and market trends, understanding and managing your emotions is equally critical. In this article, we will delve deep into the intricate relationship between emotions and Forex trading, offering insights, strategies, and tips to help you maintain control over the rollercoaster of trading.

Emotions in Forex Trading

Fear, Greed, and Hope: The Three Horsemen of Emotions

In the world of Forex trading, emotions can be your best friend or your worst enemy. The three primary emotions that come into play are fear, greed, and hope. Understanding how these emotions influence your trading decisions is crucial to maintaining profitability.

Fear

Fear often manifests in Forex trading as hesitation, causing traders to miss out on lucrative opportunities. It’s the fear of losing that can lead to analysis paralysis, preventing you from executing trades that could potentially yield substantial gains.

Greed

On the opposite end of the spectrum, greed can lead to reckless trading. When you’re driven by the desire to make more money quickly, you might ignore risk management strategies, which can result in substantial losses.

Hope

Hope can be equally detrimental to Forex traders. When you hold onto losing positions with the hope that the market will reverse, it can lead to significant financial setbacks. Learning when to cut your losses is vital.

Emotional Control Strategies

Mastering Your Emotions for Successful Trading

Create a Trading Plan

One of the most effective ways to control your emotions is by having a well-defined trading plan. This plan should include your entry and exit points, risk tolerance, and overall strategy. By adhering to your plan, you can minimize the emotional influence on your decisions.

Risk Management

Proper risk management is essential in Forex trading. Set stop-loss orders to limit potential losses and take-profit orders to secure profits. By having these parameters in place, you reduce the emotional pressure during trading.

Keep a Trading Journal

Maintaining a trading journal can be a powerful tool for emotional control. Document each trade, your emotional state at the time, and the outcomes. This can help you identify patterns and make necessary adjustments to your trading behavior.

The Psychological Impact of Trading

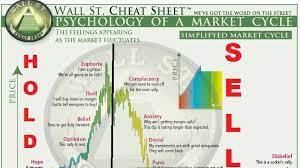

The Rollercoaster of Emotions

Forex trading can often resemble a rollercoaster ride, with exhilarating highs and heart-wrenching lows. Understanding the psychological impact of these ups and downs is critical.

Overconfidence

After a series of successful trades, overconfidence can set in. This can lead to taking unnecessary risks, which, more often than not, result in losses. Stay humble and stick to your strategy.

Stress

The stress associated with Forex trading can be immense. It’s essential to manage stress through techniques like meditation, exercise, and maintaining a healthy work-life balance.

Patience

Patience is a virtue in Forex trading. Waiting for the right opportunities and not succumbing to impulsive decisions is a hallmark of successful traders.