In the ever-evolving world of forex trading, staying ahead of the curve is paramount. To achieve success in this highly competitive arena, one must harness a comprehensive understanding of various analysis techniques. Among these, fundamental analysis plays a pivotal role. In this guide, we delve deep into the core concepts of fundamental analysis, shedding light on its significance and how it can empower traders with invaluable insights.

The Foundation of Forex Trading

Forex, short for foreign exchange, is the global marketplace for trading currencies. It’s a dynamic and fast-paced arena, where the value of currencies fluctuates constantly. To navigate these treacherous waters, traders employ a variety of strategies, with fundamental analysis being one of the most crucial.

What is Fundamental Analysis?

Fundamental analysis is the process of evaluating a currency’s intrinsic value by examining a wide range of economic, financial, and geopolitical factors. It provides a holistic view of the currency’s strength and its potential future movements. This approach stands in contrast to technical analysis, which focuses on historical price data.

Key Components of Fundamental Analysis

To become proficient in fundamental analysis, one must grasp its core components. Let’s explore these in detail:

1. Economic Indicators

Economic indicators are vital to understanding a country’s financial health and, consequently, the strength of its currency. Some of the key economic indicators include:

Gross Domestic Product (GDP)

GDP represents the total monetary value of all goods and services produced within a country. A growing GDP often signifies a strong currency.

Employment Data

Unemployment rates and job creation data provide insights into a nation’s economic stability. Low unemployment rates are generally positive for a currency.

Inflation Rates

Inflation can erode the purchasing power of a currency. Thus, low and stable inflation rates are favorable.

2. Interest Rates

Interest rates set by a country’s central bank have a profound impact on the forex market. Higher interest rates often attract foreign capital and strengthen a currency, while lower rates can have the opposite effect.

3. Geopolitical Events

Political stability and international relations play a substantial role in currency values. Elections, diplomatic relations, and geopolitical conflicts can cause significant market fluctuations.

Applying Fundamental Analysis

Now that we’ve covered the fundamental components, let’s see how to apply this knowledge effectively.

Long-Term Investment

Fundamental analysis is especially valuable for long-term investors. By assessing the fundamental strength of a currency, investors can make informed decisions regarding their long-term investment portfolios.

Short-Term Trading

Short-term traders also benefit from fundamental analysis. While technical analysis is often the primary tool for short-term traders, understanding key economic events can help them make timely and well-informed trading decisions.

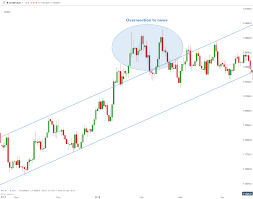

The Role of News and Research

Staying updated with the latest news and research is paramount for successful fundamental analysis. News releases, economic calendars, and financial publications can provide valuable insights into economic events that impact the forex market.

Risks and Challenges

It’s important to acknowledge that fundamental analysis is not without its challenges. Economic events can be unpredictable, and interpreting their impact on the forex market can be complex. Additionally, traders must remain vigilant and continually adapt their strategies in response to changing circumstances.